Our Inside The EV is only for paid subscribers. So as we venture into the sector deep-dive and investment opportunities in the EV sector, we want to share just this article of our Inside The EV segment for free - an opportunity for you to sign up for our upcoming deep-dive research series for only $7/month - four newsletters for the price of one. Feedback is appreciated.

Last Weekend, we wrote about Electric Vehicle Investments.

Over the next four weeks, we will deep-dive into the issue, the cost of manufacturing and owning EV, investing through the supply chain, and the investment case in the Battery Management System. Only a handful of companies worldwide have fine-tuned EV manufacturing - almost all of them are in China.

Investments are not black and white. There are trade-offs. Our trade-off to a green future is not just EV. As you read our research series, you will know the reasons.

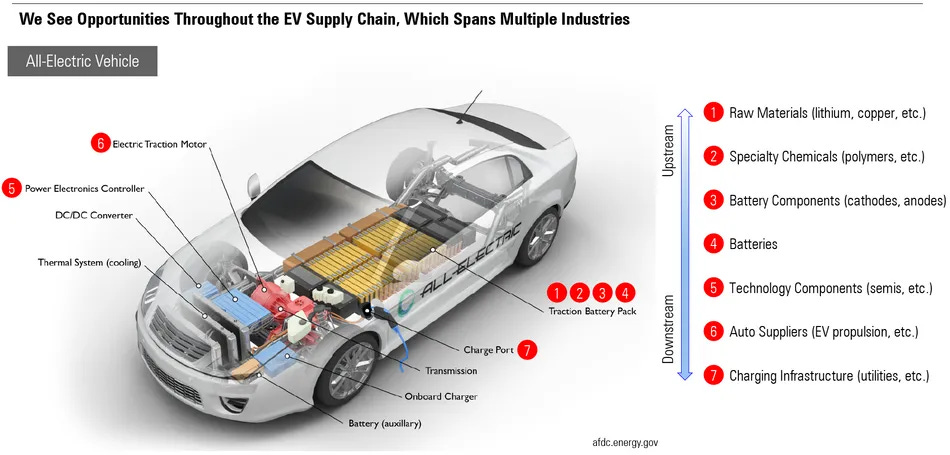

The shift to EVs involves major supply chain changes and several unknown and expensive challenges. In this introduction series, we lay the investment case for EV - The Challenge, opportunity, and the investment-worthy leaders - nuggets that lay the foundation for our deep-dive on the challenges and supply chain opportunities for the investors throughout the EV sector.

The Issue

EVs are simple compared to Internal Combustion Engines (ICE) but have heavier and more complex batteries. In addition, battery Management systems (BMS) use a higher proportion and a greater variety of minerals than ICE.

The Investment Case (Opportunity)

Investment opportunities exist beyond the automakers.

Mineral extracting, processing, and building efficient batteries are investors' goldmine of an opportunity.

Based on our research and speaking with engineers who worked on BMS for companies like BMW and QS, we understand that Batteries constitute nearly 40% of an EV’s sticker price. Therefore, investing through the upstream and downstream of an EV supply chain process will benefit investors in the long term instead of investing in car manufacturers.

The Sector Risk

Perfecting the efficiency of the Battery Management System (BMS)

Discovering alternatives to Lithium-Ion

Keeping the cost of manufacturing low

Cybersecurity infrastructure

Product safety and scalability

The Leader - China and Europe

The United States is not leading the EV sector; Europe and China are.

China According to Canalys, in 2021, over 3.2 million EVs were sold in Mainland China. Worldwide, Chinese brands account for 15% of sales in the entire automobile market, the EVs; hold 45% of global sales.

While the growth rate looks impressive, Battery Electric Vehicles (BEVs) represent only 4% to 5% of all passenger cars in the United States today. Canalys estimates that 6.5 million electric vehicles (EVs) were sold worldwide in 2021, up 109% in 2020. EV sales represented 9% of all passenger car sales in 2021.

Europe still has the highest level of EV adoption. According to canalys, EVs represented 19% of total car sales in 2021, with 2.3 million vehicles delivered. In addition, the Tesla Model 3 was the best-selling electric car in Europe in 2021. Still, Volkswagen Group was the leading manufacturer of electric vehicles, with several models from Audi, Skoda, and VW selling well.

China’s state-owned manufacturer has replaced Tesla.

BYD Auto - A company backed by Warren Buffet is officially leading the EV car race. Compared to 2020, BYD increased its plug-in EV sales by 232% and broke its record by selling 593,745 rechargeable electric vehicles in 2021. In April 2022, the company announced that it would no longer produce gasoline-powered vehicles and would shift its focus to innovative high-tech batteries, electric cars, and trucks.

Tesla led the worldwide electric vehicle market with a 14% share.

Volkswagen Group has a 12% market share. Nearly 60% of the Group’s EV sales were from the VW brand, with good support from Audi, Cupra, Porsche, SEAT, and Skoda, thus giving it a presence in various EV segments.

SAIC State-owned and headquartered in Shanghai, SAIC Motor is China’s largest automaker. The manufacturer of SAIC Motor’s brands, Wuling, Baojun, Zhiji IM, MG, Roewe, MAXUS, and R Auto, leads the EV race in China.

The Wuling Hongguang Mini EV is the best-selling EV model in Mainland China in 2021.

The Deep-Dive Into The Battery Management System (BMS)

Rechargeable batteries deliver power to the auxiliary systems and motors in electric vehicle applications. Among all rechargeable batteries, Lithium-Ion Batteries will give high efficiency for electric mobility because Li-Ion batteries have a low self-discharge rate, wide operating range, maximum energy density, and high life cycle.

Next Sunday, we will deep-dive into why BMS is a critical component in EV.

And a company that is leading the BMS technology. A brief long-term investment-worthy analysis.

As you enjoy your read, please share it with your friends and colleagues. We have 30% off for group subscriptions and introductory offers for August 2022.

Unicus Research. Unicus is a long/short investment research firm dedicated to asset managers, wealth managers, and investors. Lakshmi Ganapathi, MBA, a long-time Wall Street analyst, is the founder of Unicus Research. Unicus Research and our stable of researchers strive to be the voice of reason in the ocean of disinformation.