Important announcement:

To all the subscribers, thank you for your support.

To all free subscribers, our introductory offer is $7/month or $70/year, and you get a 7-day free trial and a one-time 15% on a Unicus Research product or service, which will end on July 31st 2022. To continue an uninterrupted reading experience, please support us by signing up now https://bit.ly/investoroffer.

Last Saturday, we wrote about What is Propelling the E.V. Sector.

This week, we dive into the E.V.s and whether we are ready to transition to an all-EV world. The short answer is NO - we are not ready. In this research segment, we will explore the investments lost this year compared to last year in the E.V. sector. We will also explore the segment worthy of investor’s investment in the E.V. sector.

ESG and E.V. - An Investment Made in Heaven or Hell?

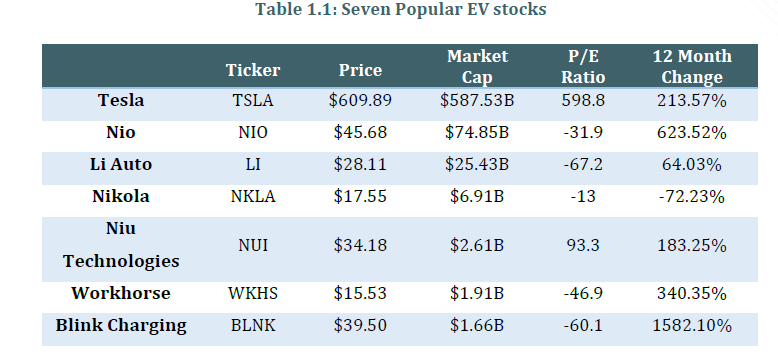

One of the most popular ESG investments in recent years has been electric vehicles (E.V.s). As a result, E.V. companies are growth stocks. Table 1.1 (prices as of June 12, 2021) shows the performance of some of the more popular E.V. stocks.

However, we know that not all E.V. companies will succeed. In the past year, at least 22 E.V. companies have gone public through SPAC listings, raising over $17 billion from investors. Meanwhile, as shown in Table 1.1, one of the larger E.V. companies, Nikola, has seen its market value fall by over 70% following an accusation that a promotional video featured a truck with a non-functioning motor.

For instance, as of July 26, 2022, five of the seven popular stocks mentioned in Table 1.1 has gone down more than 50% (see the below table). Also, we have added a few E.V. stocks that had fallen more than 70% in its value.

We researched the companies investing billions into the EV sector, and here is what we found. We also suggest the areas investors need to focus on when analyzing the financial statements of an E.V. company.