Impending Credit Risk With Focus on a Shadow Bank: Affirm

A warning...Deterioration in the Asset-Backed Securities Market

Note: This newsletter contains information for educational purposes only, and the content below should not be considered financial advice to readers. We published a brand new short recommendation for our clients. If you would like to become our client, email laks@unicusresearch.com…

Fitch recently cut its growth forecast for the U.S. in 2025 and 2026. It now expects near-term inflation to increase “due to the tariff shock,” which will push back potential rate cuts from the U.S. Federal Reserve to the fourth quarter.

In addition to the equities, we have been closely monitoring the risks in the asset-backed securities (ABS) market.

In a Nutshell, The ABS is where financial institutions create and sell bonds (or notes) backed by a pool of assets like loans, credit card receivables, or other financial instruments. This process, known as securitization, enables institutions to convert illiquid assets into tradable securities, thereby making them more attractive to investors. Investors then earn returns based on the payments from those underlying assets.

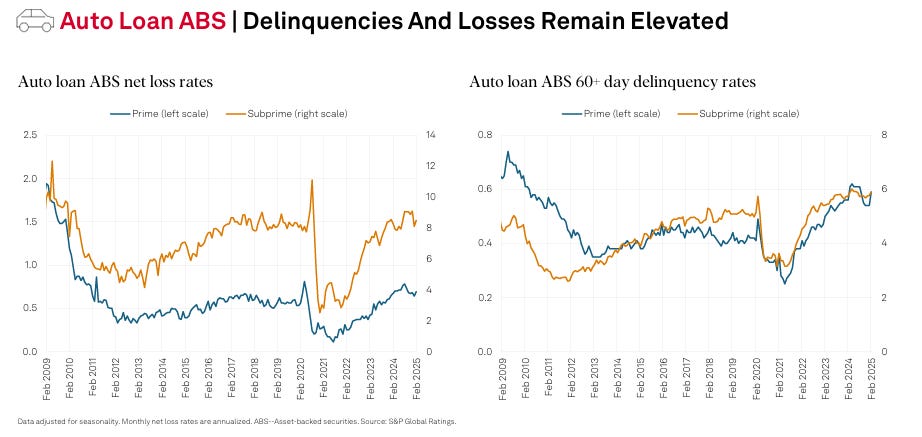

Problems: The underlying asset values of MBS, auto ABS, student loan ABS, and consumer credit ABS - both prime and subprime - are deteriorating, with some cases experiencing rapid deterioration.

Consequences: When the underlying assets in an ABS deteriorate, the value of the ABS decreases, resulting in potential losses for investors. This is because the ABS's value is directly tied to the performance of the underlying assets. Deterioration can lead to lower cash flows or defaults, which in turn impact the payments to ABS investors.

As the underlying assets deteriorate, the risk of default also increases. This means more borrowers may be unable to repay their debts, leading to further losses for ABS investors. This is the current scenario for the ABS investments - especially the consumer credit, auto loan and student loan ABS.

Why Must Investors Care?

Investors in ABS include institutional investors, such as pension funds, insurance companies, hedge funds, and asset managers, as well as individual investors.

Whomever the retail or institutional investors have entrusted their investments with might have exposure to the ABS. They purchase ABS securities to earn returns from the cash flows generated by the underlying assets.

If the originating firm goes bankrupt, the assets in the SPV are protected from the firm's creditors. However, if the underlying assets of the ABS fail to perform, ABS holders have no recourse from the originating firm.

Why Investors Have Exposure to ABS?

Diversification: ABS can provide exposure to different asset classes and sectors, diversifying portfolios beyond traditional fixed income and equities.

Higher yields: ABS may offer higher yields than traditional corporate bonds of similar credit ratings.

Structured finance: ABS are structured finance products, which means they are designed to meet specific investor needs and can be tailored to risk tolerances.

Access to specific sectors: ABS can offer access to specific areas of the economy, like consumer spending or real assets.

What about Investment Grade Ratings? - Credit Risk

Welcome to the myth. While some ABS may have investment-grade ratings, there's always credit risk associated with the underlying assets, especially after COVID.

The liquidity of some ABS markets can vary, and it's important to consider the ability to sell holdings quickly if needed.

ABS Market is Deteriorating Fast

Prime Auto Loan Deterioration: Rating Downgrade is Imminent (Fitch)

Red Flag#1

Despite low levels of unemployment, certain prime ABS issuers are reporting higher-than-expected cumulative net losses (CNLs) on their pools.

According to Fitch1, the deterioration is due to the increasing proportion of pooled loans for which obligors have a payment-to-income (PTI) ratio of greater than 10%.

PTI ratio measures the percentage of gross monthly income that goes towards a monthly car payment. Lenders use it to assess the affordability of a car payment relative to one’s income, and it's part of the overall debt-to-income ratio (DTI). When the PTI ratio exceeds 10%, it means a larger portion of one’s income is dedicated to car payments, potentially reducing your financial flexibility for other expenses and savings.

The PTI has already exceeded 10% in the pooled loans.

While industry advice has always been to not spend more than 10% of one's take-home pay on a car payment, faster growth in new and used vehicle prices relative to income since prior to the pandemic, coupled with higher interest rates, have led to a growing share of consumers facing reduced affordability on their auto loans.

The growth in loans with higher PTI ratios seems to be one of the characteristics shared among the four issuers that is driving the weakening performance for the 2023 and certain 2024 transactions. Mercedes, VW, CarMax, and Carvana have increased the percentage of loans with PTIs greater than 10% in their 2023 and certain 2024 pools, and these loans have had a disproportion share of charge-offs.