Investment Grades Aren't Breaking—It’s Eroding

When net rating bias flips negative, downgrades are just warming up.

Note: This newsletter contains information for educational purposes only, and the content below should not be considered financial advice to readers. We published a brand new short recommendation for our clients. If you would like to become our client, email laks@unicusresearch.com

Q1 Credit Check: Strength on the Surface, Stress Underneath

At first glance, Q1 looked like a win for investment-grade credit.

There were 40 upgrades compared to just 19 downgrades, with momentum coming from:

Utilities (primarily U.S.-based names),

European financial institutions, and

High-tech and real estate/homebuilders segments.

These upgrades gave the appearance of improving fundamentals, particularly in sectors benefiting from regulatory stability, easing rate pressure, or localized recovery trends.

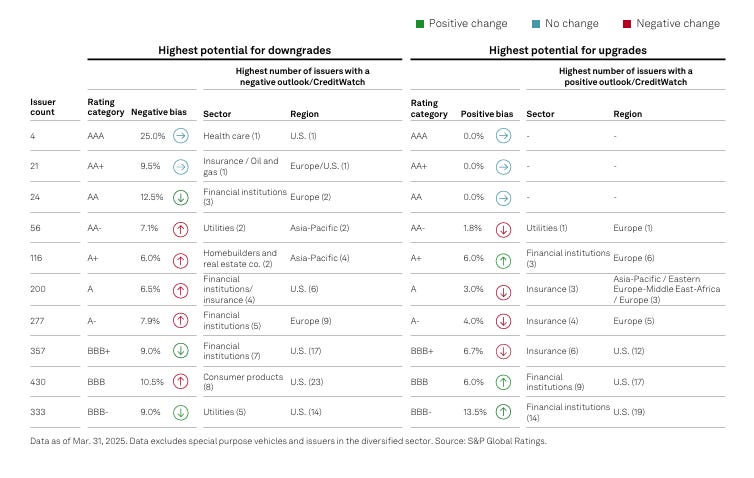

Despite the upgrade headline, the net rating bias, a forward-looking measure that subtracts negative outlooks from positive ones was below zero in nearly every sector. That means across the board, more companies were being placed on watch for potential downgrades than upgrades.

In fact, over 60% of all sectors saw a rise in negative outlooks, with three sectors leading the deterioration:

Retail: up 3.6% points

Forest products: up 4.4 ppt

Metals & mining: up 2.8 ppt

These are not small shifts. They reflect growing concern over consumer demand, commodity exposure, and operational leverage—especially in sectors tied to cyclical or discretionary spending.

Only two sectors, insurance and consumer products, closed the quarter with a net positive bias. Everywhere else, the balance of risks is skewing negative.

Sector-by-Sector Credit Pulse — Q1 and Q2 2025

While headlines focused on the upgrade count in Q1, the deeper story lies in how outlooks quietly turn negative. Sector by sector, cracks are forming, not through blowups, but through persistent, creeping deterioration that rating agencies are starting to acknowledge.