Note: We are sharing the synopsis of the earnings, and it is not financial advice. We do not discuss our short recommendations/research in the newsletter. To gain access to Unicus Research’s short ideas, email laks@unicusresearch.com.

Please note that the Unicus Newsletter is for informative purposes only and is not financial advice.

The market is an invisible chaos right now.

The underlying market forces are causing significant instability and unpredictable movements: random signaling on tariffs, provoking allies, and other signaling is giving corporations, and markets in general an unease sense of impending chaos.

It is clear how the stocks are reacting: from dealerships calling the “bottom” in consumer affordability crisis, to fearing the invisible tariffs on China, Mexico and Canada - without knowing when or where the chaos might show itself. From geopolitics to domestic consumption, corporations, consumers and global market in general are unable to perform at ease.

Here are noteworthy earnings summary for Q4 2024.

Walmart

“There is always some unpredictability in any [consumer] environment.” - CFO Rainey WMT.

“But once you take the noise out of guidance, we’re in a great spot to start the year as we grow profits faster than sales.” CEO Doug McMillan

WMT 0.00%↑ managed to beat the top-line and bottom-line with revenue of $180.6B (+4.2% Y/Y, beat of $1.6B) and Q4 Non-GAAP EPS of $0.66 beats by $0.01.

Quick Highlights: Q4 FY 2025

Total Revenue: $180.6 billion (+4.1% year-over-year)

Operating Income: $7.9 billion (+8.3%)

Gross Margin: +53 basis points, driven by improved purchasing conditions and higher membership income

eCommerce Growth: +16%, particularly driven by store-fulfilled pickup and delivery

Global Advertising Business: +29%, including 24% growth for Walmart Connect in the U.S.

Earnings per Share (GAAP): $0.65

Adjusted Earnings per Share: $0.66

Quick Highlights: FY 2025

Total Revenue: $681.0 billion (+5.1%)

Operating Income: $29.3 billion (+8.6%)

Return on Assets (ROA): 7.9%

Return on Investment (ROI): 15.5% (+50 basis points)

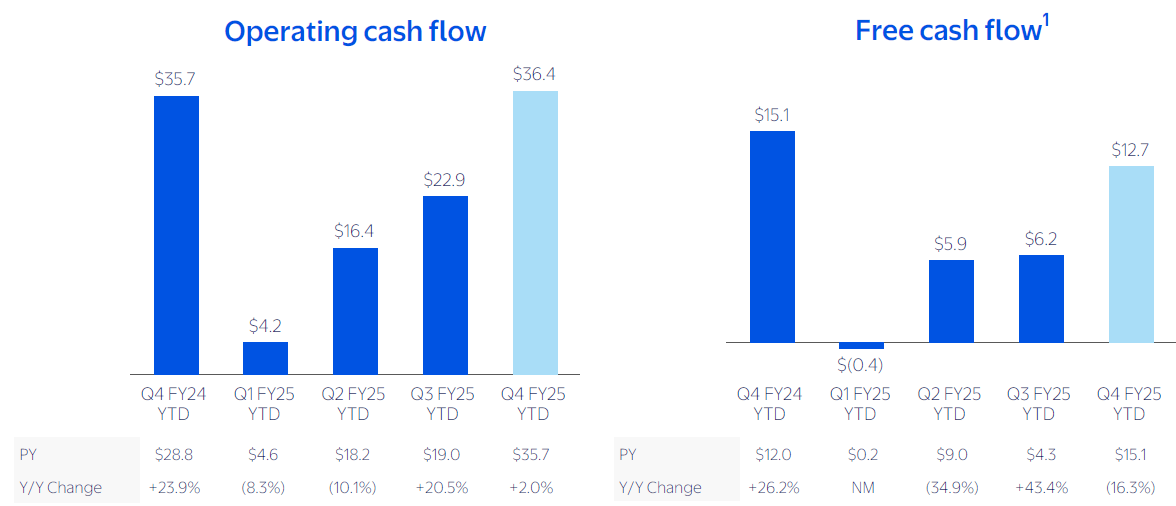

Free Cash Flow: $12.7 billion (a decline of $2.5 billion)

Dividend Increase: +13% to $0.94 per share (largest increase in over a decade)

Global eCommerce sales grew 16%, led by store fulfilled pickup & delivery and U.S. marketplace; growth negatively affected by timing of Flipkart’s Big Billion Days sales event. Global advertising business grew 29%, including 24% for Walmart Connect in the U.S.

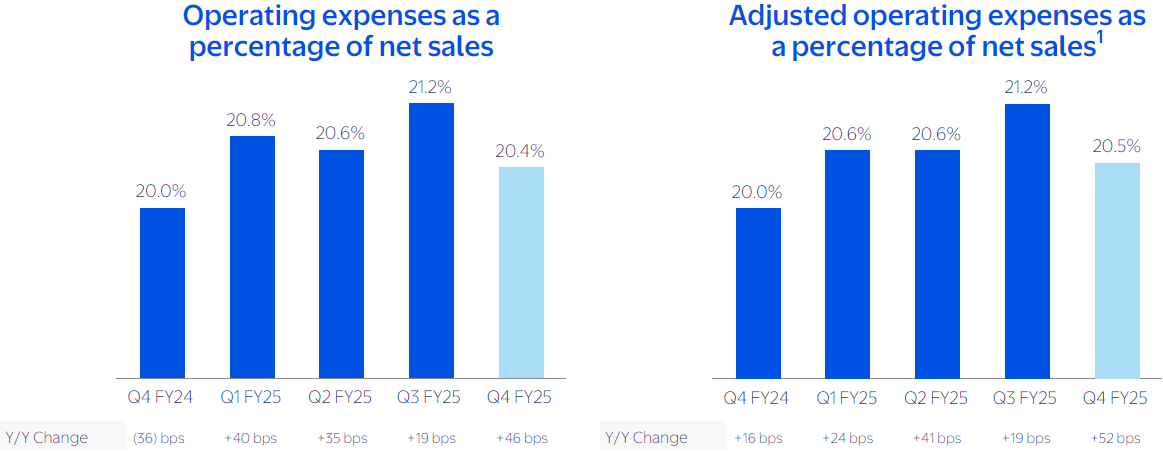

WMT managed to lower operating expenses as a percentage of net sales, but it is worth mentioning that they were higher than in Q4 last year:

Operating cash flow stagnated YOY while free cash flow decreased slightly:

Walmart U.S.

The U.S. market remains Walmart’s primary revenue driver.

Q4 FY 2025 Revenue: $123.5 billion (+5.0%)

Operating Income: $6.5 billion (+7.4%)

Comparable Sales (excl. fuel): +4.6%

eCommerce Growth: +20%.

Walmart International

The international segment showed mixed performance, with strong growth in certain markets but was negatively affected by currency fluctuations.

Q4 FY 2025 Revenue: $32.2 billion (-0.7%), but +5.7% in constant currency

Operating Income: $1.4 billion (-2.4%), but +10.1% in constant currency

eCommerce Growth: +4%.

Growth was mainly driven by China, Mexico (Walmex), and Canada. However, the shift of Flipkart’s “Big Billion Days” event impacted Q4 results, with a benefit in Q3.

Sam’s Club

Walmart’s membership-based warehouse club, Sam’s Club, continued to show stable growth.

Q4 FY 2025 Revenue: $23.1 billion (+5.7%)

Comparable Sales (excl. fuel): +6.8%

eCommerce Growth: +24%

Membership Income: +13%.

On Tariffs

Walmart did not incorporate tariffs into its financial outlook, but Rainey acknowledged that the company's isn't immune to their impact. “We're going to work really hard to keep prices low for our members and customers,” Rainey said. “We will do the things that we can.” That means being nimble with sourcing.

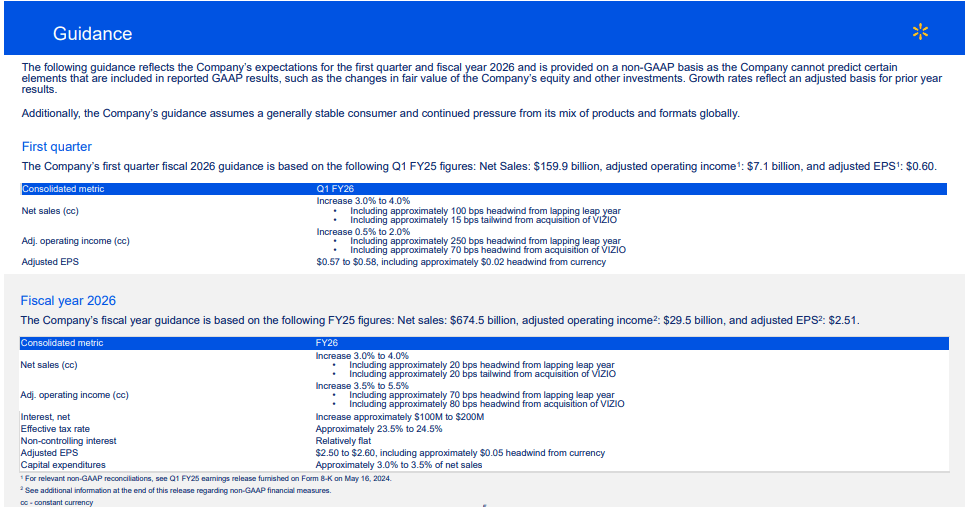

Guidance

Q126: Revenue: $166.12B consensus vs. estimated growth of 3.86% Y/Y. Non-GAAP EPS: $0.65 consensus.

FY26: Revenue: $705.14B consensus vs. estimated growth of 4.19% Y/Y. Non-GAAP EPS: $2.76 consensus.

WMT provided softer guidance and the management tried their best to downplay them.