Note: We are sharing the synopsis of the earnings, and it is not financial advice. We do not discuss our short recommendations/research in the newsletter. To gain access to Unicus Research’s short ideas, email laks@unicusresearch.com.

Please note that the Unicus Newsletter is for informative purposes only and is not financial advice.

Old Dominion Freight Line

Summary

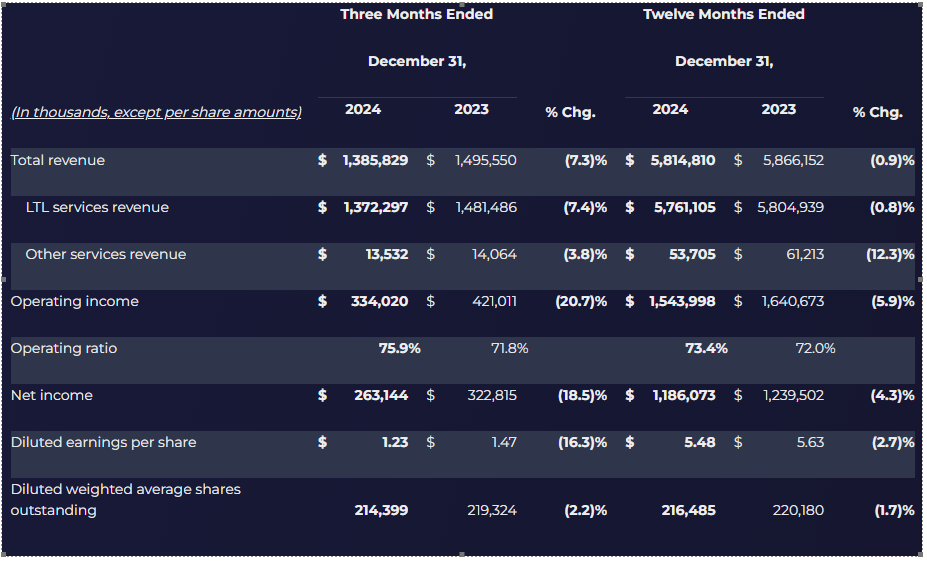

ODFL reported Q4 2024 financial results, showing a 7.3% decrease in total revenue to $1.39 billion and a 16.3% decline in diluted earnings per share to $1.23. The company's operating ratio increased by 410 basis points to 75.9%. LTL tons per day decreased by 8.2%, reflecting a 7.6% decrease in shipments per day and a 0.7% decrease in weight per shipment. The Company reported a 20.7% decline in operating income to $334 million.

Despite market challenges, the company maintained a 99% on-time service performance and a cargo claims ratio below 0.1%. The Board declared a quarterly dividend increase of 7.7% to $0.28 per share. For 2025, ODFL plans capital expenditures of approximately $575 million, including $300 million for real estate expansion, $225 million for tractors and trailers, and $50 million for technology investments. The company had $108.7 million in cash and cash equivalents at December 31, 2024.

Old Dominion Freight Line’s operating income dropped 20.7% year over year to $334 million in the fourth quarter, as drops in shipments and tonnage reflected ongoing demand softness. Here is what we think: