Note: This newsletter contains information for educational purposes only, and the content below should not be considered financial advice to readers. We published a brand new short recommendation for our clients. If you would like to become our client, email laks@unicusresearch.com…

Here is a reality check.

As of now, we do not have any trade deals. Regardless of how many trading partners the United States reaches deals with (which we are not), the one that really matters is China. China is in no rush to make any deals with the United States; on the contrary, China is actively engaging with Europe. Beijing sees a strategic window of opportunity to drive a wedge between the United States and Europe and improve its economic and trading relationship with the European Union. We have successfully created a “strategic uncertainty”—that is not a good thing for the end consumers.

ONGOING CHALLENGES

CONSUMERS

Consumer credit is drying up faster, thanks to the student loan resumption and BNPL reporting to the credit agencies.

Americans are using Buy Now, Pay Later loans to purchase groceries, and BNPL is slashing credit availability.

China's response to the U.S. tariffs, including countertariffs, adds to the already challenging environment for auto and parts makers. Beijing's actions represent a risk not only for issuers producing in the U.S. and exporting to China but are a source of potential disruption for global supply chains.

Consumer bankruptcy filings have increased in May 2025. Data from the Administrative Office of the U.S. Courts shows a 13.1% rise in total bankruptcy filings over the previous year, with non-business filings increasing by 13.0%.

CORPORATIONS

As of May 1 2025, corporate downgrades outnumbered upgrades and included a fallen angel, U.S.-based consumer producer Whirlpool Corp.

Three-quarters of downgrades originated from three sectors: consumer products, forest products, and building materials, and real estate.

The weekly default count rose to four, up from just one in the previous week, with two issuers each from Luxembourg and the U.S., and three due to distressed exchanges.

Our Analysis on Consumer Credit and Corporate Downgrades/Defaults and Bankruptcies

CONSUMERS

Bankruptcy filings dropped during the pandemic as federal aid helped people pay their bills. But since then, bankruptcy filings have been steadily on the rise. As we continued to share with our clients, the stimulus packages of 2025 created a fall sense of economic relief and reality for many consumers; especially when mortgage, student loan and credit card forbearance.

Since March 2020, approximately 8.5 million mortgage borrowers in the US have received forbearance, and approximately 235,000 homeowners are currently in forbearance plans.

For credit card debt, the peak in forbearance was 4.1% of balances in May 2020, with a rapid decrease to 0.2% by August 2021. Millions of borrowers have used forbearance for student loans, with 61.2% having loans in forbearance.

In addition to NOT paying back any debt, consumers opted to ADD more debt to their daily lives. The birth of layaway 2.0 - Buy Now, Pay Later.

BNPL's use has spiked during the COVID-19 pandemic and throughout the holiday shopping season.

With tariffs coming, new car prices are likely to increase $4-5,000, just when new car prices were starting to fall. Car manufacturers that were aggressively selling cars in 2024 with greater incentives; however, in 2025, they’ve cut back. Buying a new car remains out of reach for most consumers. Consumers are actively seeking longer-term auto loans, which lowers the payments today, but creates a greater risk of default later.

Here is the problem. According to a survey by the Federal Reserve of Boston, BNPL users have fewer liquid assets and more debt. On average, a BNPL user has $2,179 in their checking account, whereas other consumers have an average of $6,638. While users and non-users are equally likely to have a credit card, BNPL users are significantly more likely to revolve on their credit cards: 71% of users revolved on their credit cards in 2023, compared with 40% of non-users.

As a result, users are likely to accrue high interest costs on every dollar they charge on their credit cards. They are also likely to have reached the credit limits on their credit cards, preventing them from further borrowing.

NOW

With the student loan resumption, BNPL began reporting consumer credit usages to the credit rating agencies. Since last month, banks have begun to throttle BNPL consumer credit. There is a bigger issue.

RED FLAG#1

According to a survey published by Lending Tree on April 23, 2025:

25% of BNPL users say they’ve used the loans to buy groceries. That’s up from 14% just a year ago, amid rising prices at the supermarket. One-third of Gen Z BNPL users say they’ve done so, making it the fourth-most common BNPL purchase for that age group, trailing clothing, technology and home decor.

Two-thirds of BNPL users say they’d consider using it for food delivery, and many are putting their money where their mouth is. DoorDash and BNPL giant Klarna recently announced a partnership to allow customers to pay for DoorDash deliveries with BNPL. However, we found that 16% of BNPL users say they’ve already used BNPL for restaurant food delivery or takeout.

RED FLAG# 2

Consumers are expected to file more bankruptcies in 2025 to escape overwhelming debt, driven by factors like rising interest rates, inflation, and the end of pandemic relief measures.

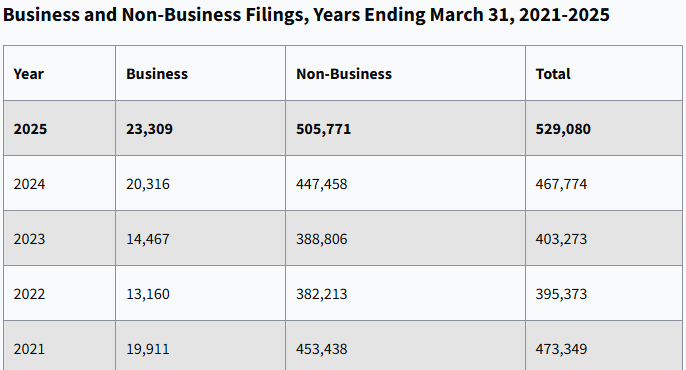

Bankruptcy filings rose 13.1% during the 12-month period ending March 31, 2025. That is a similar rate of acceleration as in the Dec. 31, 2024, quarterly report, but new bankruptcy cases remain significantly lower than after the 2007-08 Great Recession.

According to statistics released by the Administrative Office of the U.S. Courts, total filings rose to 529,080 cases, compared with 467,774 cases reported during the year ending March 31, 2024.

Business filings increased 14.7%, from 20,316 in March 2024 to 23,309 in the newest report. Non-business filings rose 13%, from 447,458 in March 2024 to 505,771 in March 2025.

RED FLAG# 3

As of May 5, 2025, the federal government resumed collecting on defaulted student loans, ending a five-year pause during the COVID-19 pandemic.

The Department of Education says federal student loan borrowers who fail to pay on time could damage their credit scores and even have their wages garnished, their tax refunds seized, and even see reductions in social security benefits beginning on 5 May —This is misleading. The garnishments on the defaulted loans won’t begin until late summer.