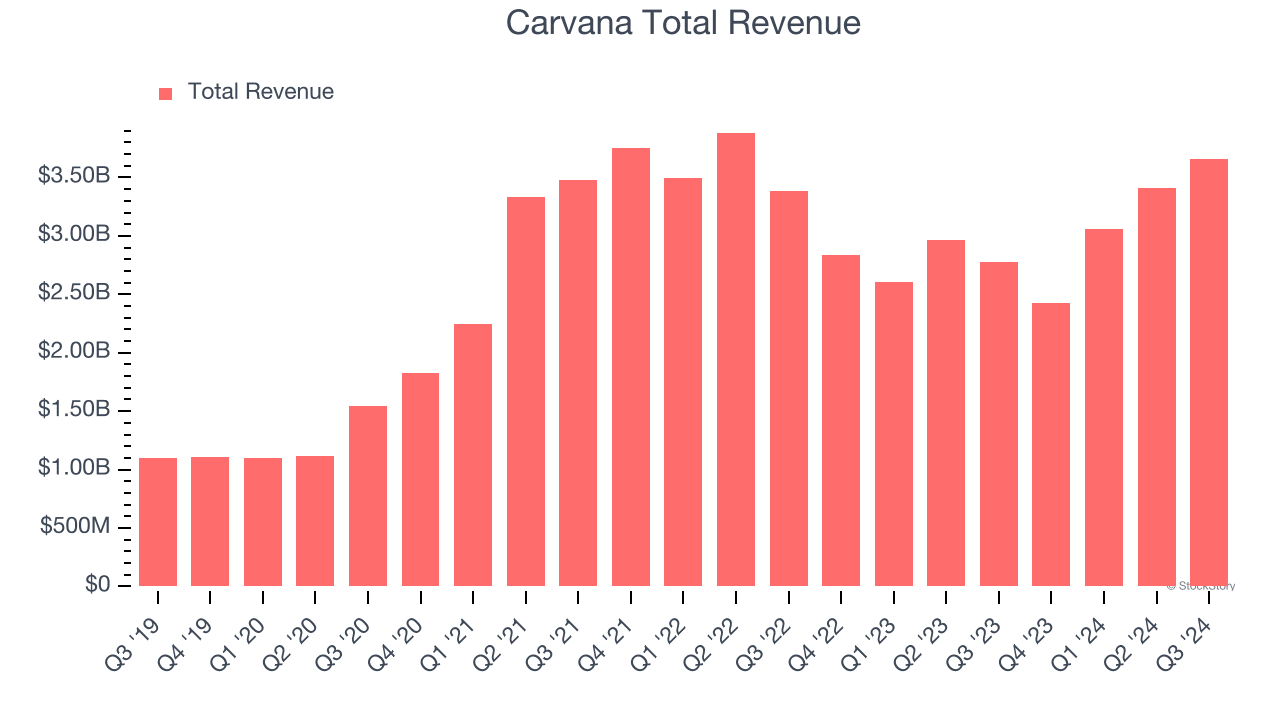

Carvana is a cult stock. We do not recommend this as a short to our clients. Here is our take on CVNA’s earnings tomorrow. Carvana beat analysts’ revenue expectations by 5.7% last quarter, reporting revenues of $3.66 billion, up 31.8% year on year.

Carvana Co. reports fourth-quarter earnings after the market closes on Feb. 19. Analysts monitoring the online used-vehicle retailer expect it to cap 2024 with quarterly double-digit vehicle sales growth.

Wall Street expects CVNA 0.00%↑ 's revenue to grow 38% year on year to $3.35 billion, a reversal from the 14.6% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.32 per share.

Analysts expect Carvana to announce annual retail sales of more than 400,000 used cars and trucks in 2024. Sales the prior year were notably more muted as Carvana, of Tempe, Ariz., dialed back volume to address profitability.

Wall Street Expects Double-Digit Growth

who issued outlooks on Carvana ahead of its fourth-quarter report estimated the company sold more than 100,000 retail used vehicles in the three months ended Dec. 31.

William Blair research analyst Sharon Zackfia wrote in a Feb. 11 note Carvana likely sold 109,000 used vehicles in the fourth quarter, up 43 percent from 76,090 in the year-earlier period. Analysts at J.P. Morgan published a higher estimate — 115,000.

Implications of tariffs on used demand

Carvana leadership may field questions from analysts about President Donald Trump’s trade policy during the company’s fourth-quarter earnings call.

The company does not sell new vehicles that would be subject to delayed 25 percent U.S. tariffs on Canadian and Mexican imports. Still, company leaders may be asked if they anticipate an uptick in U.S. consumer demand for used vehicles in 2025 if tariffs drive up new-vehicle prices.

Questions after Hindenburg Research short report

Carvana leadership also likely will receive questions about a Jan. 2 report on the company by Hindenburg Research, a now-disbanded short-selling firm known for exposing financial irregularities at automotive startups Nikola and Lordstown Motors.

Hindenburg in its report listed several concerns about Carvana’s valuation, accounting and underwriting practices. It alleged — among other claims — that lender Ally Financial had concerns about the credit quality of Carvana’s finance receivables. Carvana has historically counted Ally as a lender to which it can sell receivables.

Carvana disputed the report shortly after its publication, calling it “intentionally misleading and inaccurate.” Carvana and Ally also renewed an agreement for the lender to purchase up to $4 billion in used-vehicle loan receivables through the start of 2026, according to a Jan. 6 regulatory filing by Carvana.

Plans for competing online auction product

Carvana in February announced it will expand and develop ADESA Clear, an online auctions product that combines the company’s digital capabilities and ADESA’s auction-lane experience, in 2025.

ADESA, the U.S. physical auction network Carvana acquired in 2022, developed and started testing ADESA Clear in late 2023. Carvana plans to grow Clear in 2025 by adding “more selection, new features and broader geographic reach,” according to a news release.

Carvana said Clear inventory is available across online sales each week from ADESA physical auctions and Carvana inspection and reconditioning centers in the following metropolitan areas: Washington, D.C.; Atlanta; Birmingham, Ala.; Charlotte and Raleigh, N.C.; Jacksonville, Sarasota, Tampa and Orlando, Fla., New Jersey; Phoenix; and Los Angeles. It did not disclose the number of vehicles available on Clear as of February.

According to estimates from Jeff Lick, a Stephens Inc. analyst who maintained a bullish outlook on the retailer in February, Carvana is likely to sell more than 500,000 retail and 260,000 wholesale vehicles in 2025.

The ADESA Auction acquisition is going to have more drag than sail. It thrived as a local car wholesaler auction - dealer-only buyers, but technology that Carvana has used to its advantage will be a serious disadvantage to the old bricks-and-mortar ADESA. It takes a lot of capital to open retail car sales locations - not so wholesale, especially online - from dealer to dealer.