Note: We are sharing the synopsis of the earnings, and it is not financial advice. We do not discuss our short recommendations/research in the newsletter. To gain access to Unicus Research’s short ideas, email laks@unicusresearch.com.

Please note that the Unicus Newsletter is for informative purposes only and is not financial advice.

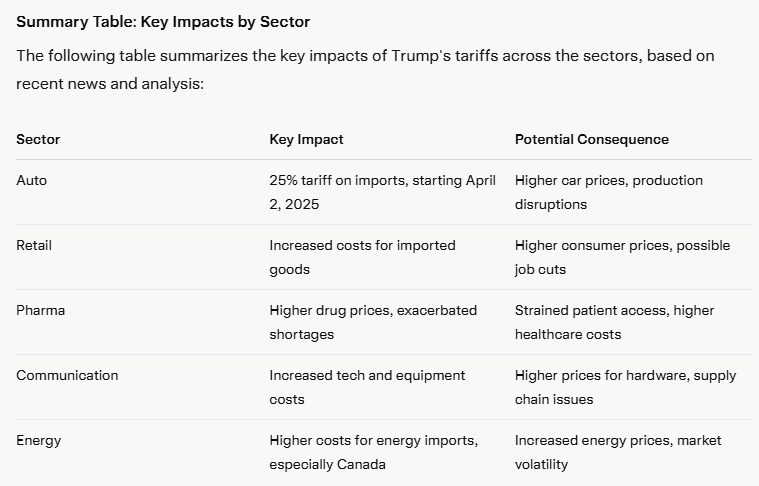

Summary

Automotive Sector: Tariffs in Focus

The auto sector is currently grappling with President Trump's announcement of a 25% tariff on auto imports, set to begin on April 2, 2025. This policy, detailed in a recent Reuters article (Reuters Autos), aims to protect domestic manufacturers but could significantly raise car prices for consumers. The tariff, initially threatened during Trump's first term but not enacted, is now moving forward, potentially disrupting global trade and forcing automakers to reconsider production strategies. Analysts suggest this could lead to a 30% decrease in production for high-exposure vehicles, as noted by S&P Global Mobility, impacting companies like General Motors and Volkswagen, which rely heavily on cross-border supply chains.

Here are the top news today

Stellantis Faces Leadership and Brand Strategy Challenges: Stellantis is actively seeking a new CEO, with Chairman John Elkann prioritizing the evaluation of the company's 14 brands to determine their future viability.

India Implements EV Charging Investment Cap: In anticipation of Tesla's market entry, India plans to cap investments in electric vehicle (EV) charging infrastructure to secure tariff relief, according to a recent document.

BMW Reviews Electric Mini Production Plans: BMW is reassessing the timeline for producing its electric Mini in the UK, indicating potential adjustments to its manufacturing strategy.

Ford and Tesla Issue Vehicle Recalls:

Ford: The company is recalling over 240,000 vehicles in the U.S. due to potential seat belt issues.

reuters.com

Tesla: Tesla has recalled 376,000 vehicles in the U.S. over power steering concerns, leading to a decline in its stock value.

Retail Sector: Rising Costs and Consumer Impact in Focus

In the retail sector, Trump's tariffs on imports from Canada, Mexico, and China are expected to increase the cost of consumer goods, as reported by NPR (NPR). This is particularly concerning for retailers like Shein and Temu, which depend on low-cost imports. The National Retail Federation estimates a potential loss of $78 billion in annual spending power for Americans, with price hikes likely for apparel, toys, and furniture. Britain's retailers are also facing challenges, with reports of job cuts and price increases due to rising taxes, adding to the sector's woes. This could lead to a broader economic impact, with consumers potentially reducing spending amid inflation pressures.

Here are the top news today

Retailers Brace for Potential Auto Tariffs: Automotive dealers are preparing for possible declines in sales as new auto tariffs loom, which could impact the retail automotive market.

J.C. Penney, Eddie Bauer operator lays off 5% of corporate staff: About 250 people at Catalyst Brands, which also runs Aéropostale, Brooks Brothers, Nautica and Lucky Brand, were let go.

Store closures outpace openings amid ‘historic shift’ to service-based tenants: Bankruptcies have driven “a clear acceleration of closure announcements” in recent months as distressed retailers have indicated they will close part or all of their brick-and-mortar store portfolios.

Pharmaceutical Sector: Drug Prices and Supply Chain Risks in Focus

The pharma sector is at risk of higher drug prices and exacerbated shortages due to Trump's tariffs, as highlighted by CNBC (CNBC). The tariffs, including a 25% rate on Canadian and Mexican imports and 10% on Chinese goods, could disrupt the supply of generic drugs, which constitute 90% of U.S. prescriptions. Industry groups like AdvaMed warn of potential shortages of medical supplies, with increased costs for APIs (active pharmaceutical ingredients) from China, where 80% are sourced. This could strain patient access, especially given existing drug shortages, and lead to higher healthcare costs, affecting both insurers and patients.

Here are the top news today

FDA Declares Shortage of Novo Nordisk's Medications: The U.S. Food and Drug Administration has declared a shortage of Novo Nordisk's medications, including Wegovy and Ozempic, affecting patients and healthcare providers.

Novartis to Acquire Anthos Therapeutics: Novartis has announced plans to acquire Anthos Therapeutics for up to $3.1 billion, aiming to strengthen its cardiovascular portfolio.

Energy Sector: Tariff Impacts on Prices and Supply Chains in Focus

In the energy sector, Trump's tariffs are expected to increase costs for imports, particularly from Canada and Mexico, potentially leading to higher energy prices, as reported by Reuters (Reuters Energy). Canadian oil producers may face a $3 to $4 per barrel discount, with limited export alternatives, while Mexican energy exports could see similar pressures. The tariffs, set at 10% for Canadian energy resources, could disrupt supply chains, with analysts warning of volatility in commodities markets. This could lead to higher fuel prices at the pump, affecting consumers and industries reliant on energy inputs.

Here are the top news today

Eneos Seeks Up to $3 Billion in IPO: Japanese energy company Eneos is seeking up to $3 billion in its initial public offering, marking the largest IPO in Japan since 2018.

Stellantis Unveils Automated Driving Technology: Stellantis has launched STLA AutoDrive, its first in-house-developed automated driving system, featuring hands-free and eyes-off capabilities at speeds up to 37 mph.

cbtnews.com