We are in the middle of the first-quarter earnings season. This brings us to this weekender: There are some equities you should not buy.

Bank Stocks

According to the FDIC, in 2012, there were 6,089 banks with 85,106 branches.

In 2022 it had been reduced to 4,135 banks with 71,190 branches.

The banking industry has been consolidating for decades, and the trend has only accelerated. Consolidation and technology permit banks to cut costs. However, it only exacerbates the problem of lack of diversity.

In a study of banking today, you have near complete and total homogenization. The banking regulations are so smothering and all-encompassing that you have 4,135 clones. It is a nearly perfect competitive desert – a perfectly even and level playing field with the possibilities for finding or exploiting an asymmetric advantage near zero.

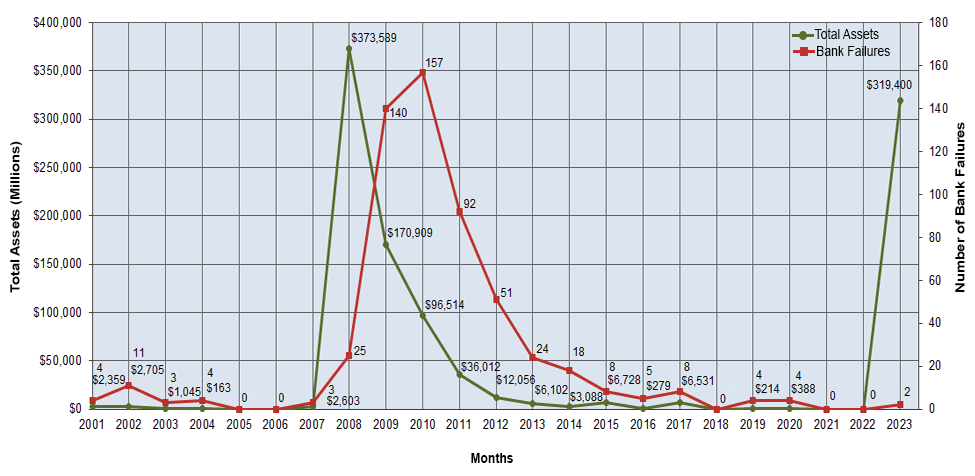

In the 2008 - 2009 banking crises, the banks lost more money in two years than they made in the history of the United States. In 2007 three banks failed with assets totaling about $2.7 Billion. In 2008, 25 banks failed with $375 Trillion in assets. That is a 1,388% spike in failures. The cascade of banking failures rippled through the economy and continued with higher-than-average bank failures until 2015. It is April of 2023, and we have had two bank failures representing $319 billion in assets. In 2008 and 2009, laws were passed to ensure this would never happen again: Sarbanes Oxley, Dodd-Frank, and more.

FDIC Bank Failures in Brief – Summary 2001 through 2023

“The Dodd-Frank Wall Street Reform and Consumer Protection Act and the Emergency Economic Stabilization Act (EESA), which created the Troubled Asset Relief Program (TARP) helped to quell the financial crisis of 2008. The creation of the CFPB and FSOC helps to monitor financial institutions and protect consumers. Key components addressed by these legislative moves include mortgage standards, investor protections, systematic risk, and bank regulation.”[i]

Oh boy, wasn’t this great?

Another law to keep banks from failing after they failed. The Federal Reserve also imposed stress tests to ensure the banks and financial institutions could weather market perturbations. Yeah, another problem. However, the rise in interest rates and competition from shadow bankers are a few market forces the stress test models did not anticipate. Both SVB and Signature banks were not required to undergo these stress tests. The banks argued that they were not systematically important.

Also, as shareholders, you are at the end of the income line. Everybody comes before you, depositors, debt-secured and unsecured, general overhead, lawyers, accountants, and if there is anything of substance left, it's bonus time. Banks have a nifty deal going on. If the banks make money, is it because the bankers are smart. Bonus time. If they lose money, it is a black swan event, and need a bailout. Bonus time. It is a head I win, tails I win - lottery. The banks are gambling with investors and taxpayer money and cannot lose. The banking environment is ugly and loaded with perverse incentives. As the wave of failures hit (I hope I am wrong), it is likely to be more severe as the economic and foundational DNA of the banks is too similar.

The facts are undeniable.

Solar and Solar Installers

Never trust an industry whose business model dangles at the end of a hair strand held in place by the whim of a sovereign.

Solar manufacturers and solar installers are in this market space. They live on tax credits as well as the ability to finance any installation. From 2019 to 2022, the market was fat. There were new and better solar panels. There were more innovative mounting brackets, power inverters, and monitoring programs. In 2021 we started to see some genuine pushback from the utility companies. The utility company knew their demand cycles and when they would have to add or reduce peak power. The utilities could dial in power needed more or less in a moment. As solar and wind started to become significant mandatory sources of electricity, power companies started to figure out how to work with the sharp peaks and drops of green energy generation.

To cope with the problems of power fluctuations, the utilities needed to keep smaller peaking plants online or ready to go online if there were unexpected clouds, storms, or wind speeds. The cost of coping with solar and wind generation was passed on through increased interconnection fees and charges by nearly all residential power generators. The shipping cost from China increased by 1,000% from May 2020 to October 2021. While the shipping costs have dropped, it is still 300% more today than in May 2020. According to our installer sources in the solar industry, the interest rates to finance any installation have risen from 6%-10% to more than 22%.

The additional installed capacity per year has peaked and held steady at 20 MW. The blended average price per watt had gone as low as $1.40 but now is up to about $1.80 because of increased panel and installation costs.[ii] Most residential consumers see five advertisements for solar installation every week. The competition has become fierce for what remains of the withering market for residential installation. It has become a buyer's market for solar power installations. As competition continues to increase, some participants fail. We have started to see complaints on solar installers to state contractors’ boards skyrocket. Many residential buyers have been left with debt but no working solar panels. That also means the lenders on solar are starting to see defaults.

“Companies have misled consumers about the true costs of installing solar panels, provided shoddy craftsmanship, and left homeowners with higher utility costs, all while forcing them to sign unconscionable contracts that leave little possibility of recourse.”[iii]

The unspoken problem is the warranties. Most warranties are for 25 years on the productive life of a solar panel. Dodgy power converters are part of the warranty. From the BBB on Enphase:[iv]

“After just three months, 42% of the microinverters failed. It's been 6 weeks and they are still down; installer cites RMA delays, but they sure had plenty available when they installed them.”

“Enphase Energy **** does not honor its warranty! No customer service, only lip service.”

Now Solar Edge[v]:

“My Solaredge sytem has two inverters and they have both failed. The first one lasted a year and was replaced by my original installer for free. The second inverter lasted a little over two years and I had to find a new installer to handle the warranty. There was not an installer within 100 miles of me listed on their site. The new company said they only cover $125 labor after 2 years and no labor after 5 years under warranty to replace the inverter and it will cost $1000 labor for them to replace the failed inverter. So I am now on the hook for the difference. When I was talking to the new installer they said there is a 15-20% failure rate of the inverters. So far I am at 100% and my parents inverter has also failed on their system making it a perfect 3 for 3. Only leaving a one star rating because you cant leave a zero!”

“The shittiest company that any poor soul should ever have to deal with...downright pitifully substandard crappy crappy company from the cradle to the grave... be warned!!!”

“I used to believe in this product, and I have lost all faith. I am an installer that bought into the hype of solaredge, optimizers, and service. I have a backup system on my own house, and in the middle of a power outage, my system did not go into backup mode. …”

An assurance-type warranty is accounted for as a contingency which requires recording a loss when the conditions in are met. That is, the loss is recorded when it is probable and can be reasonably estimated. Accordingly, the estimated costs are generally recorded as a liability when the reporting entity transfers the good or service to the customer. The liability that many solar manufacturers were estimating was failure rates of less than 1%. If the BBB and the installers we have spoken to are any indications – the failure rates are much higher just 2 to 3 years out. What will it be in 5, 10, or 15 years?

The Streams of Default

The defaults will be a slow process. Many of the solar loans are 2nd mortgages and sometimes have a lien on the steam of income from the power company in case of default. It is cold comfort that a home with solar panels demands a paltry 4% premium over homes without solar. Yes, yes, the tax credits were extended and increased. The meager increase does not even come close to offsetting the brutal fundamentals.

It will be at least two years before much of this is settled by the marketplace and by litigation.

The Weekender Music Sampler

A beautiful classic piano piece

The Crystal Method – Trip Like I Do

Some serious EDM

Contributor

L. Burke Files, CACM DDP

Senior Research and Advisor to the Founder

Unicus Research, LLC

[i] https://www.investopedia.com/ask/answers/063015/what-are-major-laws-acts-regulating-financial-institutions-were-created-response-2008-financial.asp#:~:text=The%20Bottom%20Line-,The%20Dodd%2DFrank%20Wall%20Street%20Reform%20and%20Consumer%20Protection%20Act,financial%20institutions%20and%20protect%20consumers.

[ii] Solar Energy Industries Association

[iii]https://campaignforaccountability.org/

[iv] https://www.bbb.org/us/ca/petaluma/profile/solar-energy-equipment-dealers/enphase-energy-inc-1116-360280/customer-reviews

[v] https://www.bbb.org/us/ca/milpitas/profile/solar-energy-equipment/solaredge-technologies-inc-1216-1532097/customer-reviews

You mixed up billions and trillions, e.g. : " It is April of 2023, and we have had two bank failures representing $319 Trillion in assets."

A bit of Push Back. There were and are few barriers to installing solar, or for that matter, hot water heaters, roofs, or HVAC units. As for makers of solar panels, they are bought in China, and the resellers here will go bust. No resellers will replace old ones. The problems will not go away. New mopes will replace old mopes.